PPSR Check Australia – What the PPSR Register Shows for a Used Car

Buyers across Australia still talk about doing a "REVS Check" before they hand over a deposit. In practice, that means confirming whether a used car has money owing against it, appears on a written-off register, or has been recorded as stolen. This page explains what a modern REVS Check covers and how to run one properly.

About this page:

This PPSR Check overview is maintained by AUCN Car Report to help Australian buyers understand PPSR results in plain English. It reflects how PPSR searches are used in real-world used car purchases and is designed to support clearer, safer buying decisions.Enter a rego or VIN and state. You can review a summary first, then choose whether to purchase the full report.

What a modern PPSR Check includes

A PPSR vehicle search is a targeted check against Australia’s official register for security interests. For used car buyers, a PPSR Check focuses on the core risks that can cost you the most if you miss them:

Finance owing (security interest / encumbrance)

Whether a lender or secured party has registered an interest over the vehicle’s VIN. If finance is still owing and not cleared properly, the car can be at risk of repossession.

Written-off status

Whether the vehicle is recorded as written-off in official datasets used for PPSR motor vehicle results. Written-off status can affect safety, registration, and resale value.

Stolen status

Whether the vehicle has been reported as stolen in relevant feeds used for PPSR motor vehicle results.

Core identifiers (VIN match)

VIN-based matching so you can confirm you are checking the correct vehicle — a critical step when a rego plate has changed or when listings contain typos.

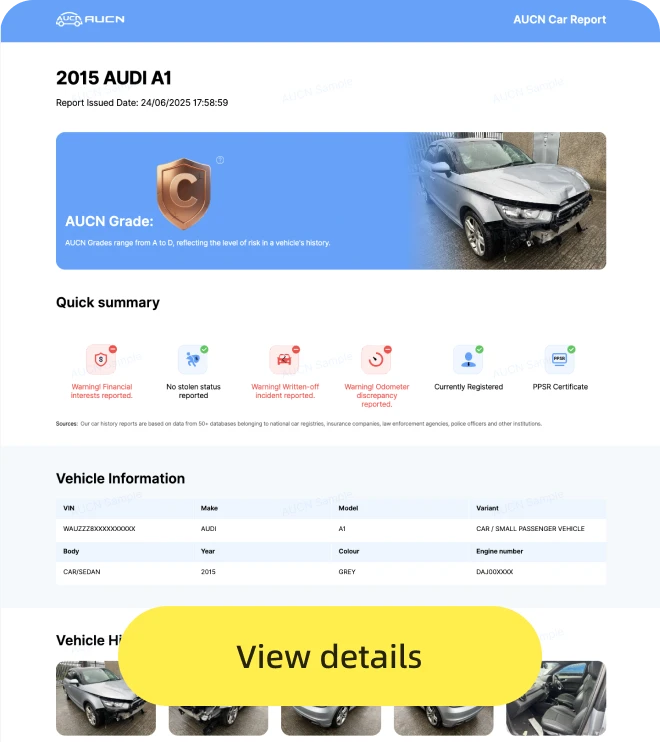

Preview: AUCN PPSR Check report

Why many buyers use a report instead of a raw certificate

A raw legal certificate answers important questions, but the wording can be hard to interpret during a real inspection. An AUCN Car Report packages PPSR results into a buyer-friendly format that is easier to act on:

- Readable summaries of finance owing, written-off and stolen status in plain language.

- Risk prompts that explain what each PPSR outcome typically means for a buyer (and what to do next).

- Indicative valuation context for the specific model and year, so you can read PPSR results alongside pricing reality.

The goal is to help a buyer decide whether to proceed, negotiate, or walk away — not just download a certificate and guess.

PPSR, a registry search and a full AUCN report

| Aspect | PPSR (official) | Raw PPSR certificate | AUCN PPSR Check report |

| Scope | National register for security interests over personal property (including vehicles). | Legal-style certificate output from the register search. | Registry-backed results presented for used car buyers. |

| Key buyer risks | Finance owing (security interest), plus motor-vehicle result feeds for written-off and stolen status. | Shows registry outcomes but requires interpretation. | Highlights outcomes with plain-English explanations and risk tags. |

| Readability | Registry language by design. | Often hard to interpret under time pressure. | Plain-language summaries + next-step guidance. |

| Decision support | Confirms specific legal/registry outcomes. | Limited context beyond the certificate fields. | Adds valuation context and practical prompts to reduce costly mistakes. |

In everyday language, buyers say “PPSR Check” because it’s the clearest way to confirm finance owing and serious register risks before you pay a deposit. What matters is that your check is VIN-based and easy to interpret.

PPSR Check FAQs

· What is a PPSR Check for a car in Australia?

A PPSR Check is a search of the Personal Property Securities Register for a vehicle’s VIN. It helps you confirm whether there is a security interest (finance owing) registered against the car and provides key register outcomes for buyers.

· Is a REVS Check the same as a finance / risk search on the national register?

Yes. PPSR is Australia’s official national register for security interests over personal property. For vehicles, finance owing is checked against the VIN via PPSR.

· Can I do a PPSR Check with just a rego number?

You can often start with rego and state, but the PPSR search itself is VIN-based. A buyer should ensure the final check is run against the correct VIN for the vehicle being purchased.

· What does “security interest” mean on a PPSR result?

A security interest generally means a lender or secured party has registered an interest over the vehicle. If it’s not properly cleared before you buy, the car can be at risk even after you’ve paid.

· Does a PPSR Check show all accidents?

No. PPSR is not a complete accident history database. It focuses on finance owing and key register outcomes for written-off and stolen status. A pre-purchase inspection, service records and other checks are still essential.

· Is a clean PPSR result enough to buy safely?

A clean PPSR result is a strong sign for finance owing, but it does not confirm mechanical condition, service history, minor damage, or price fairness. Buyers should combine PPSR with inspection and pricing checks.

Related guides and resources

· REGO & Legal

How to Transfer Rego When Buying a Used Car in Australia (NSW, VIC, QLD Guide)

Read more

· History & Risk

How to Spot Odometer Rollbacks and Odometer Inconsistencies in Australia

Read more

· History & Risk

Does a REVS or PPSR Check Show Accidents? The Truth Every Australian Buyer Should Know

Read more

· History & Risk

Written-Off Vehicles Explained: WOVR Codes, Categories & What Australian Buyers Must Know

Read more